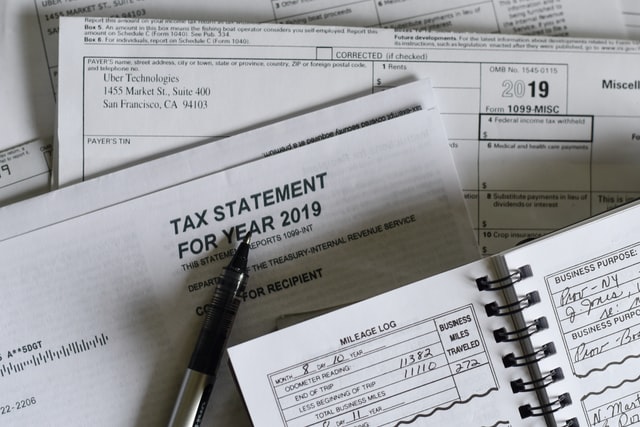

The Honeymoon is Over – It’s Time to Think Taxes!

Remember: An extension to file is not an extension to pay taxes

For most taxpayers (including individual, businesses, and fiduciaries), the filing and payment deadline for their 2019 federal and state tax returns was postponed to July 15. Those who need more time to file beyond the postponed date (July 15) can request an extension to file and must request that extension to file by July 15. The federal extension gives taxpayers until October 15 to file their federal tax return.

Taxpayers need to check with their individual state’s laws to determine the effect of an extension. In Arizona, a federal extension filed by July 15 allows taxpayers to file their state tax return by January 15, 2021. If a federal extension is not filed, then Arizona Form 204 (individual) needs to be filed by July 15 to extend time to file Arizona returns.

Take heed of the following good advice so you are not scrambling to respond on July 15!

- An extension to file is not an extension to pay! Taxes must be paid in full by July 15 to avoid penalties (fed and state)! So budget now to make that tax payment for your 2019 liability.

- Understand the penalties! There is a failure to file penalty and a failure to pay penalty (fed and state). These are separate penalties and accrue over time to a maximum of 25% each of the tax you should have paid.

- Failure to timely file and fully pay the tax liability by July 15 will result in penalties and interest. If you cannot pay, at least file to avoid the failure to file penalties (fed and state).

- Do not ignore your omission to file or pay tax. Call your friendly tax attorney for assistance in negotiating a reasonable payment plan. Often, the IRS agents will seek large payments that you cannot afford. It is best to insert a tax attorney between you and the IRS agent to arrive at a reasonable and sustainable payment plan.

- Call McFarlane Law - A Tax Law Firm. All we do is negotiate with the IRS and ADOR and resolve taxpayer’s problems.

If you need assistance filing your 2019 returns or making tax payments to the IRS or ADOR, call McFarlane Law – A Tax Law Firm with offices located in the Phoenix – Scottsdale – Tempe – Glendale – Peoria metro areas for a consultation of your facts and issues.

McFarlane Law – A Tax Law Firm - resolves tax problems for taxpayers located in Maricopa County, Pima County, Pinal County, Coconino County, Cochise County, Phoenix, Peoria, Mesa, Tempe, Scottsdale, Tucson, Flagstaff, Prescott, Cottonwood, Sedona, Sierra Vista, Casa Grande.